Streamline Your Business

Financing with a True Line of Credit.

Get fast, flexible access to capital, on your terms. Our expert team helps you unlock credit lines tailored to your goals, without the complexity of traditional banks.

- Instant Access

- No Hidden Fees

Access

draw from $10K to $5M as needed

Terms

12-month repayment resets after every withdrawal

Flexibility

customizable weekly payment options

Instant

funds available 24/7—within seconds*

WORKING CAPITAL

Get the best use

of funds with us.

Only pay for

what you borrow

Withdraw what you need,

when you need it. You’ll only be

charged interest on the

funds you draw.

Instant funding,

no questions

Receive your money within seconds when you make a withdrawal — 24/7, even on

nights and weekends.*

Build

Business credit

We report to business credit bureaus, which helps build business credit with on-time payments.

From $10,000 up

to $5,000,000

We offer extended lines

of credits with the dollar

amount going up to

$2,000,000 for your

flexibility.

Are we a Match?

1 year

in business, at least.

Business

checking account.

Frequently Asked Questions

Check our consolidated list of frequently asked questions to help you navigate our lines of credit

How does my line of credit payback work?

With a DirectCapitalExpress – Line of Credit, draws are consolidated into one loan with one easy weekly payment. As you pay back your principal, you replenish available funds. Unlike most other online lenders, our line of credit comes with no draw fees (just a monthly maintenance fee). Adjust the payment amount and term to ensure a comfortable weekly payment.

Can I get a credit line increase?

There are some times when you could really use access to additional funds. Based on your cash flow, net income and payback history, you may be eligible for a credit line increase.

How much will it cost?

The total cost of your line of credit will vary based on a number of factors, including your personal and business credit scores, time in business and annual revenue and cash flow.§

What other small business loans can I get in addition to my line of credit?

You may have a project that could benefit from other types of small business loans beyond your business line of credit. At DirectCapitalExpress we understand, and we offer term loans that provide lump-sum funding up to $250,000. Reach out to your dedicated loan advisor if you think a term loan could help your business.

How can I use my line of credit to build business credit?

We report your payments to business credit bureaus so that every time you pay on time, you’re helping your business build a strong credit profile.

What are the types of business lines of credit?

Secured business line of credit. This type of line of credit requires businesses to put up specific assets as collateral. Since a line of credit is a short-term liability, lenders typically ask for short-term assets, like accounts receivable or inventory.

Unsecured line of credit. While this type of line of credit doesn’t require specific collateral, your lender will likely place a general lien on your business and require a personal guarantee from you. You’ll likely need a stronger credit profile to qualify and interest rates may be higher. Additionally, keep in mind that unsecured lines of credit typically come with a lower credit limit.

Revolving line of credit. With this type of line of credit, you replenish your available funds as you repay what you borrow. This gives you access to future funding without needing to reapply. DirectCapitalExpress business line of credit is a revolving line of credit.

Non-revolving line of credit. A non-revolving line of credit is just like a revolving line of credit except your available funding doesn’t replenish as you make payments. You’re given a capped credit limit, and when you reach that amount, you exhaust your funding.

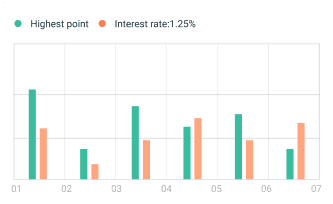

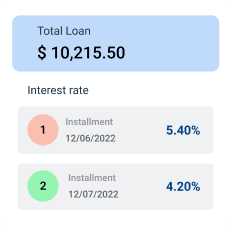

LOAN CALCULATOR

Calculate and confirm your loans

Business Form Loan

Let’s Talk About Funding

That Works for You

Whether you’re ready to apply or just have questions, our team is here to guide you.

No pressure, no commitments. Call or click to get started

Or give us a call:

(720) 905-0614

DirectCapitalExpress is a trusted leader in small business funding, providing reliable and fast capital solutions across the U.S.